It’s predicted that the base rate will hold at 5.25% when the Bank of England (BOE) meet next month. Here’s everything you need to know about the upcoming base rate and how it could affect mortgages.

When are the BOE meeting?

![]()

The Bank of England meet next on the 2nd November, 2023.

What’s the current base rate?

![]()

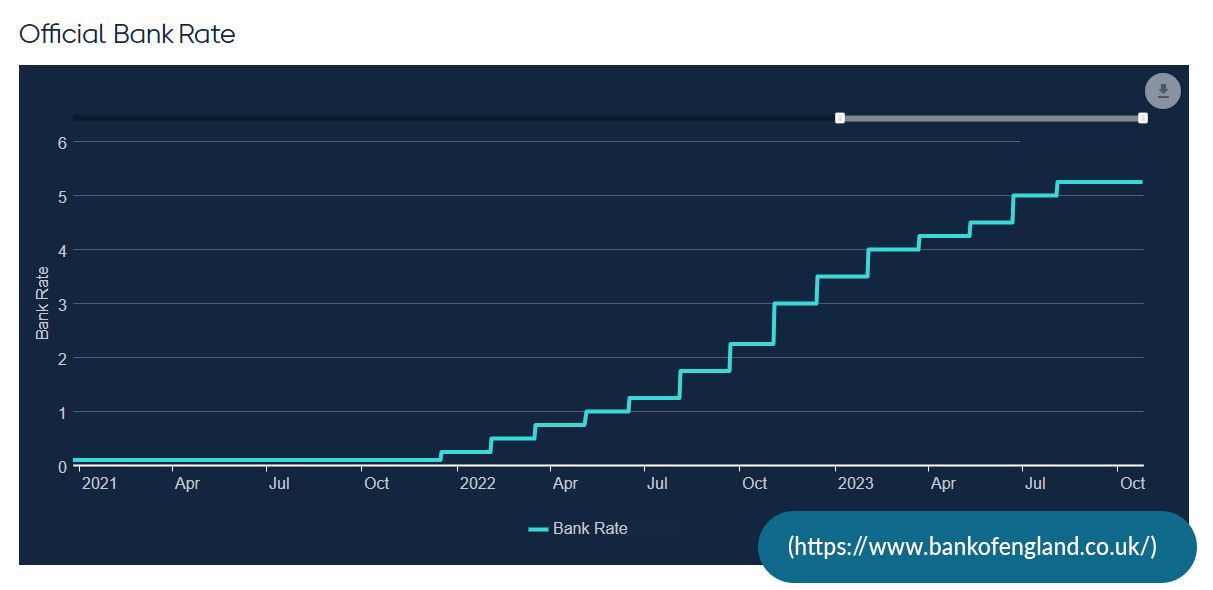

The current base rate stands at 5.25%, the highest its been since February 2008.

What’s caused the rise?

![]()

The primary reason the Bank of England raise the base rate is to combat high inflation. High inflation makes good and services less affordable, reducing the purchasing power of millions of households in the UK.

The Bank of England has set a specific inflation target of 2% inflation. As of September 2023, the most recent figure for inflation was 6.7%, meaning the bank it unlikely to drastically reduce the base rate anytime soon.

What’s next for rates?

![]()

Economists in the UK are anticipating that the base rate will remain steady at 5.25%.

Initial forecasts from earlier this month suggested a potential increase to 5.5%, but these projections have been revised due to troubling unemployment data released by The Office for National Statistics.

In addition to this, UK businesses have been reporting sluggish growth or even stagnation in recent months.

What does this mean for mortgages?

![]()

Broadly speaking, mortgage lenders increase and decrease interest rates to reflect the bank’s decisions.

With this in mind, those reaching the end of their fixed-term mortgage period may be contemplating transitioning to a variable rate mortgage, hoping for an upcoming decrease in the base rate. However, the likelihood of a rate reduction appears slim, with a base increase seeming far more plausible.

The good news for homeowners, in response to the recent decision by the bank to stop rate hikes, several lenders have begun introducing a wider array of products back into the market. This makes the present moment as good as any time to contemplate the prospect of remortgaging.

Need help from an expert?

![]()

Remortgaging can feel daunting, especially in the current economic climate. If you’re in the process of remortgaging and feel like you could use some help, our CeMap qualified advisors are waiting for your call. As a whole of market brokerage, we scan thousands of offers, working with you to find a deal that fits your needs.

The initial call is free and we’ll work to gauge how we could help you remortgage, free up cash or consolidate debts.

Call 01489 346624 if you would like to chat to us about your options.

Financial info: Your home may be at risk if you do not keep up repayments. Think carefully about securing debt against your home. When consolidating existing borrowing, be aware that extending the term could increase the amount repaid.